Date

14/February/2024

Share

Revolutionizing Finance: The Impact of Banking as a Service (BaaS)

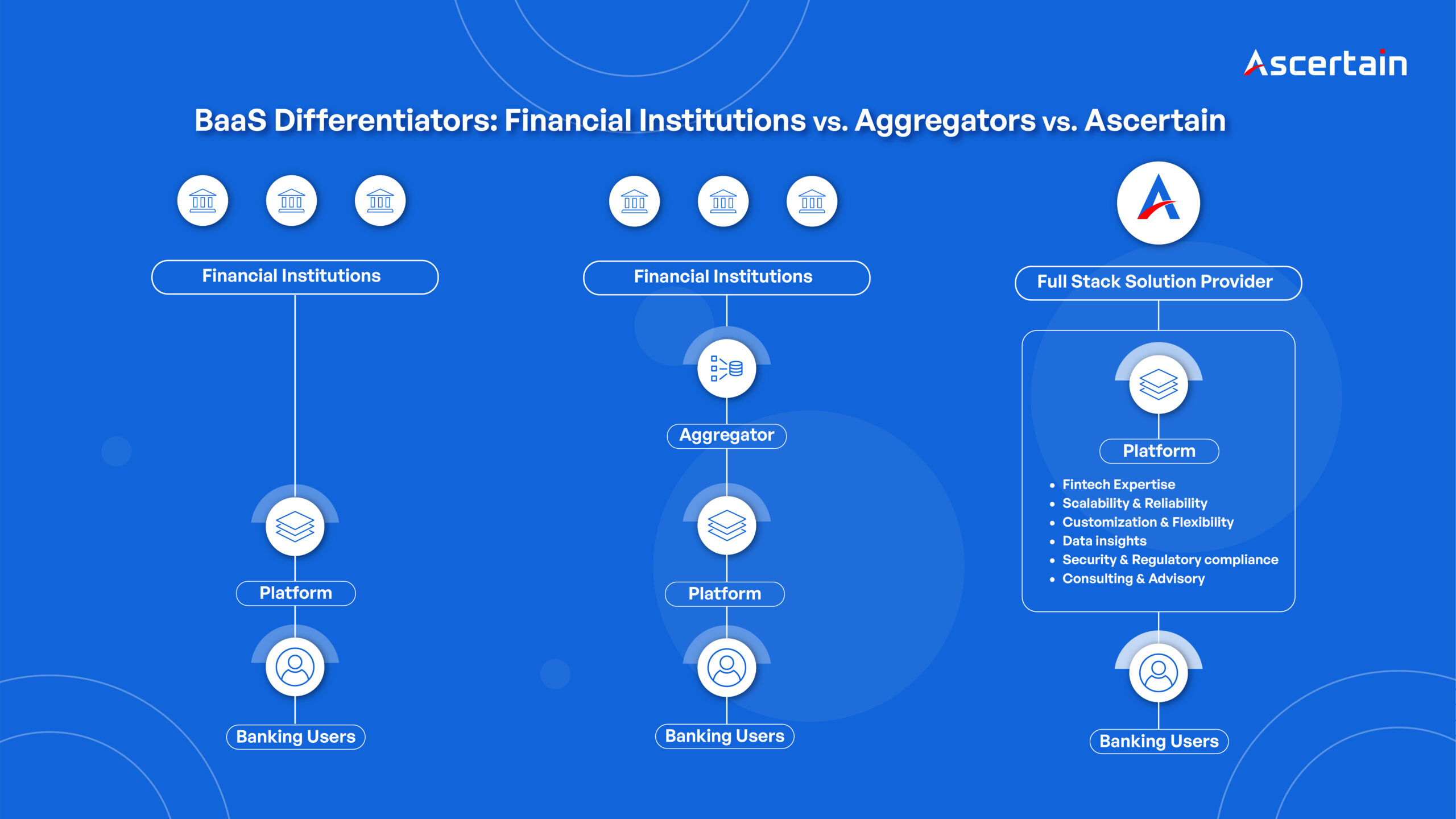

Ascertain Technologies is your trusted partner in unlocking the full potential of Banking as a Service. With over 15 years of industry expertise and a global presence across 12+ countries, we offer a comprehensive suite of fintech solutions designed to empower businesses of all sizes.

- We provide a comprehensive range of BaaS offerings, including Payment Gateway and Collection Services, to meet our customers’ diverse needs.

- Explore our cutting-edge products like DataFuze and Lending Management System, designed to elevate your banking experience to new heights.

- Elevate your banking infrastructure with our Digital cloud transformation services, coupled with essential Application Re-Engineering, to stay ahead in the fast-paced financial landscape.

Banking as a Service represents a paradigm shift in the financial services industry, offering platforms and marketplaces unparalleled opportunities for innovation and growth. By embracing BaaS, businesses can unlock new revenue streams, enhance user engagement, drive operational efficiency, and achieve quicker go-to-market with an experienced technology partner like us. As the fintech landscape continues to evolve, choosing the right BaaS provider is essential for realizing the full potential of this transformative technology. With Ascertain Technologies by your side, you can embark on a journey of financial empowerment and unlock new possibilities for your business.