Date

23/November/2023

Share

The Essence of InsurTech: Tradition Meets Innovation with Ascertain Technologies

- Digital Onboarding: Streamlining customer entry into the digital realm, reducing paperwork, and enhancing the onboarding experience.

- Data Analytics and AI: Leveraging advanced analytics and artificial intelligence to gain valuable insights, optimize risk assessment, and personalize customer experiences.

- Claims Processing Automation: Accelerating and automating the claims processing journey, reducing errors, minimizing turnaround times, and enhancing customer satisfaction.

- Blockchain for Security: Utilizing blockchain technology to enhance security, transparency, and trust in transactions and data management.

- Customer-Centric Platforms: Focusing on creating platforms that prioritize customer needs, offering personalized experiences and intuitive interfaces.

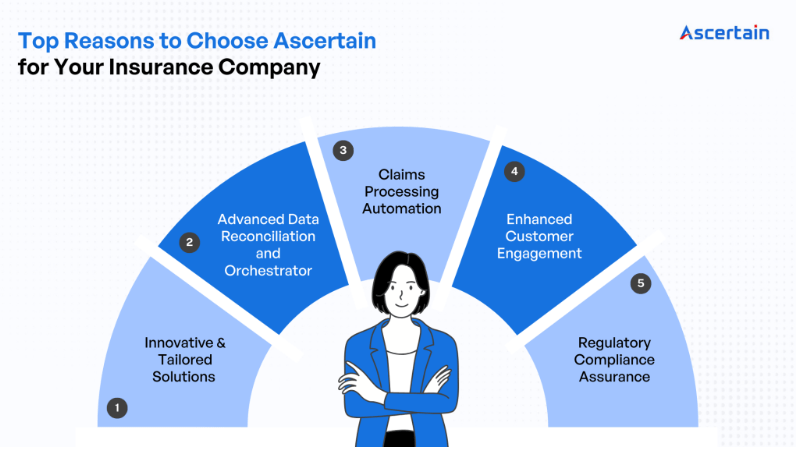

- Innovative & Tailored Solutions

- Advanced Data Reconciliation and Orchestrator

- Claims Processing Automation

- Enhanced Customer Engagement

- Top-Tier Security Measures

- Regulatory Compliance Assurance