Date

12/February/2026

Share

Reimagining Payments Infrastructure Through the AWS Cloud

How modern cloud-native architectures are reshaping national and regional payment rails

Payments are now the backbone of every digital economy. What used to be a simple transactional layer has evolved into a high-speed, high-risk, always-on ecosystem, powering everything from instant transfers and cross-border remittances to digital wallets, BNPL, subscription billing, and real-time corporate treasury flows.

Yet across ASEAN, the Middle East, and South Asia, many banks and payment providers are still operating on legacy monolithic infrastructure systems that were never designed for today’s velocity, volume, or volatility.

And the cost of inaction is rising sharply.

When payment systems fail to scale, the consequences are immediate and unforgiving:

- Service outages during peak usage (salary days, festivals, high-volume shopping periods)

- Increased fraud exposure due to delayed detection or log processing

- Regulatory penalties for downtime or settlement delays

- Customer churn because expectations for real-time payments are now absolute

- Lost revenue and reputational damage that compound with every minute of downtime

This is why financial institutions across the region are accelerating a shift toward AWS-powered cloud-native payment rails systems built for real-time, resilience, and regulatory trust.

Why Legacy Payment Systems Can’t Keep Up?

Traditional core systems and older payment platforms typically suffer from:

- Fixed compute capacity = guaranteed failures during peak traffic

When traffic surges, for instance, the rise of instant payments, DuitNow peak volumes, FPX spikes, Eid/Diwali shopping periods, the legacy systems cannot elastically scale.

The result: timeouts, failed transactions, and settlement delays.

- Siloed data + slow processing = delayed fraud response

Modern fraud detection requires continuous event streaming. Legacy databases and batch-based processing mean that logs, transaction events, and authentication signals are processed with delay, sometimes minutes or hours after the fact. This delay creates blind spots, allowing fraudulent transactions to slip through before alerts can be triggered.

- High operationalfragility

Monoliths mean that if one component fails, everything fails.

A 20-minute outage can trigger cascading failures across payment gateways, merchant systems, and even partner banks.

- Unsustainable scaling model

Scaling legacy infrastructure requires:

- Hardware procurement

- Data centre allocation

- Long patching cycles

- Manual load redistribution

It’s slow, expensive, and unreliable.

AWS: The Engine for Modern Payment Rail Transformation

The most forward-thinking BFSI institutions today are shifting towards modular, cloud-native architectures built on AWS-native services designed for speed, elasticity, and compliance.

Amazon ECS (Elastic Container Service): The foundation for digital payment agility

ECS allows payment providers to run microservices that scale automatically based on traffic spikes.

This is crucial for:

- Instant payment switching

- Merchant acquiring platforms

- Cross-border routing

- Transaction lifecycle orchestration

Instead of scaling overnight or manually, ECS scales in seconds, ensuring that downtime does not become a business liability.

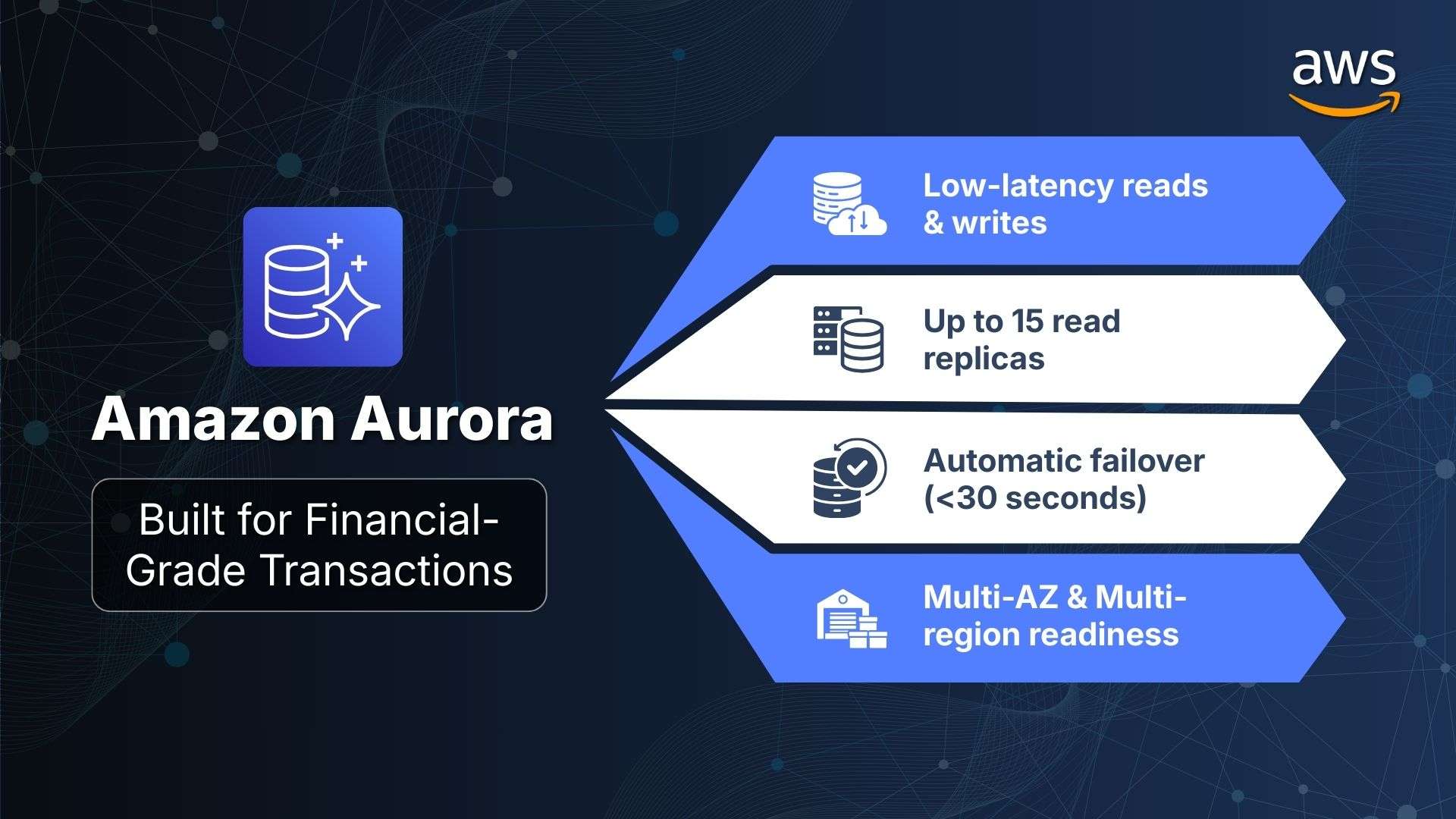

Amazon Aurora (RDS): High-performance, strongly consistent transactional database

Most core payment workloads require strict consistency and high-volume transactional integrity which is why Aurora Serverless (MySQL/Postgres compatible) is widely adopted for BFSI systems.

Aurora Serverless delivers:

- High throughput & low-latency reads/writes

- Up to 15 read replicas for scale-out performance

- Automatic failover within 30 seconds

- Multi-AZ & multi-region replication options

- Strong consistency models needed for payment authorisation, settlement, and reconciliation

AWS Lambda: Event-driven payment processing at scale

Lambda is ideal for:

- Real-time fraud detection triggers

- Payment orchestration events

- Notifications, refunds, retries

- Compliance logging

Because Lambda only runs when triggered, it enables banks to scale intelligently while optimising cost.

The real impact: Resilience + compliance + elasticity

By combining ECS, RDS, and Lambda, BFSI organisations achieve:

- Elastic scaling during unpredictable traffic spikes

- High availability and fault tolerance across regions

- Sub-second processing for AML/Fraud ML models

- Regulator-ready resilience frameworks

This is why modernisation is no longer optional, it’s a competitive and regulatory necessity.

The Hidden Cost of Not Scaling Your Payment Infrastructure

Across the region, failure to modernise payment architecture is one of the top reasons financial institutions fall behind. The risks compound quickly:

- Market Share Erosion

Consumers won’t tolerate failed payments or slow settlement. Competitors who offer frictionless digital experiences capture the market instantly.

- Higher Fraud Losses

Legacy platforms struggle to ingest real-time data for ML-based fraud detection leading to delayed alerts and higher exposure.

- Regulatory Non-compliance

Regulators in ASEAN and GCC regions are tightening uptime requirements:

- 99.95% minimum availability

- Real-time reporting

- Faster reconciliation

- Active-active architecture requirements

Institutions that can’t meet these face fines and reputational damage.

- Unsustainable Infrastructure Costs

Continuing to scale monoliths means:

- More hardware

- More data centre costs

- More patching

- More operational overhead

Cloud-native architectures convert this into predictable, efficient OPEX.

How Ascertain Builds Cloud-Native Payment Ecosystems on AWS

Ascertain’s payment architecture incorporates AWS-native best practices across multiple live environments, including implementations for RinggitPay, a Malaysian digital payments ecosystem operating at national scale.

With RinggitPay, Ascertain has applied:

- Microservices-first architecture on ECS

Ensuring merchant onboarding, routing, settlement, and payout modules operate independently without cascading failures. - Aurora RDS–powered real-time transaction data layer

Aurora’s strong consistency and automated failover directly support RinggitPay’s uptime and reliability requirements. - Lambda-driven event orchestration

Handling triggers for fraud alerts, FPX payment status checks, webhooks, refunds, and asynchronous workflow events. - Multi-region, multi-AZ

Designed to meet Malaysian regulatory expectations for resilience and continuity. -

ML-powered fraud & risk modules

Enhancing anomaly detection and suspicious pattern identification across high-volume FPX and DuitNow transactions.

This real-world implementation demonstrates how AWS-native design patterns translate into operational resilience, compliance, and measurable business outcomes in the Malaysian payment ecosystem.

Conclusion: The Future of Payments Belongs to the Cloud-Native, Always-On Institutions

The next wave of financial innovation will be driven by those who can:

- Scale instantly

- Secure aggressively

- Operate with 99.99% uptime

- Innovate faster than regulatory cycles

- Deliver real-time intelligence at every transaction

Legacy systems were built for a world that no longer exists. Cloud-native payments are built for a future that is already here.