Date

1/August/2023

Share

Online scammers and fraudsters running rampant: Do we fight back or run for our lives?

With cybersecurity spelling a major headache across the globe, fraud expert Trace Fooshée, in a new Aite-Novarica report, has underlined the growth in scams and the challenges they pose to the people by highlighting that we may be on the verge of what he calls a “scampocalypse”. Some of the biggest fraud threats across the globe includes authorized push-payment frauds, impersonation scams, e-commerce crimes, and phishing, which could lead to account takeovers and unauthorized transactions.

In Malaysia, with the number of victims and reported cases increasing by the day, many people and organizations, like Bank Negara Malaysia and Bursa Malaysia, are worried that more Malaysians could soon be falling for scams and frauds. This is where financial literacy plays a huge part. Malaysians will need to be given the right information and made aware of the different scams that are out there.

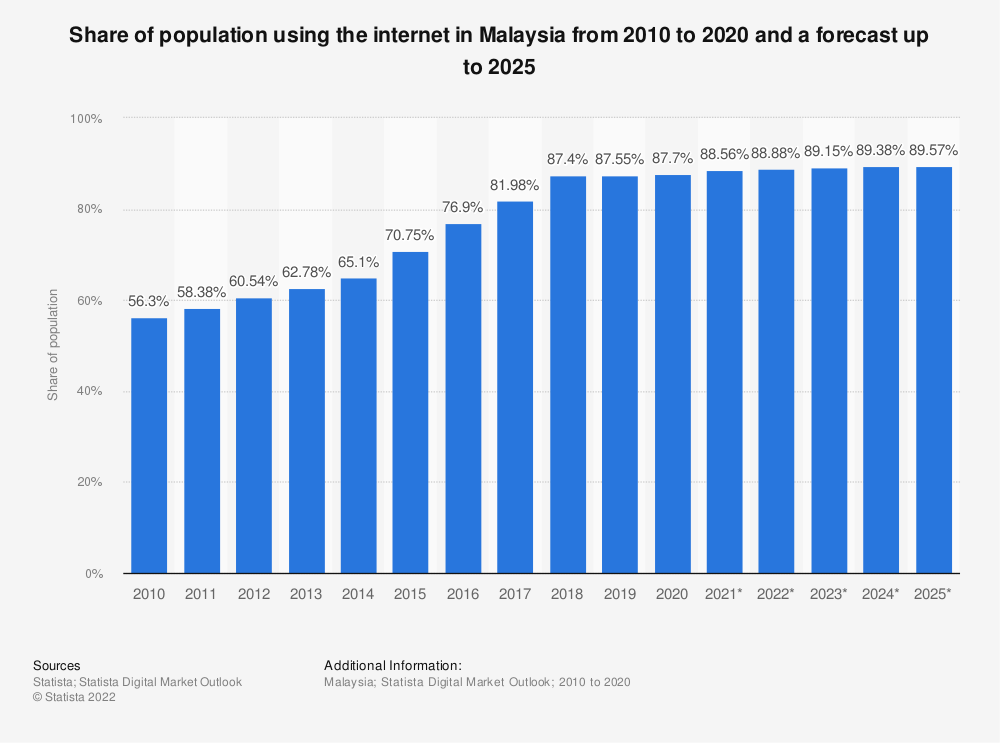

With so many people using the Internet, e-commerce, digital, and social media on a daily basis, users will need to be taught more about how to stay safe and away from scams in the online world. This is important to ensure more Malaysians are safe from falling into the traps of highly efficient scammers and hackers.

Key initiatives like KPDNHEP and Meta Malaysia’s #TakNakScam campaign, Bursa Malaysia’s “Sens-Ability” financial and investment literacy program, and Bank Negara Malaysia’s nationwide “Financial Literacy Month 2022” #FLM2022 campaign are some recent examples of well-received approaches that have been implemented to help the public become more aware of online scams and fraud.

Notably, the #TakNakScam campaign, which aimed to create awareness and guide the public on how to spot, check, and report deceptive tactics employed by scammers via Facebook, Instagram, and WhatsApp, was very well received by the public.

On top of the wide traction and engagement rates secured across various social online campaign channels, Meta Malaysia highlighted that it noticed a downward trend in the number of scam cases that were reported during the five-month period of the campaign.

It is also interesting to see how different countries have adopted diverse approaches to teach their people about cybersecurity, scams, and financial literacy. Let’s look at some interesting examples from the UK, China and India, for example.

UK: In the U.K., one of the earliest approaches implemented in combating scams and fraud was to establish a consistent and streamlined taxonomy on scams and fraud terminologies across the entirety of the market. As there are as many different definitions of what constitutes to a scam, this consistent taxonomy, as outlined in UK Finance, aimed to properly define key terminologies related to scams and refine the definitions and categorisation of scams and frauds.

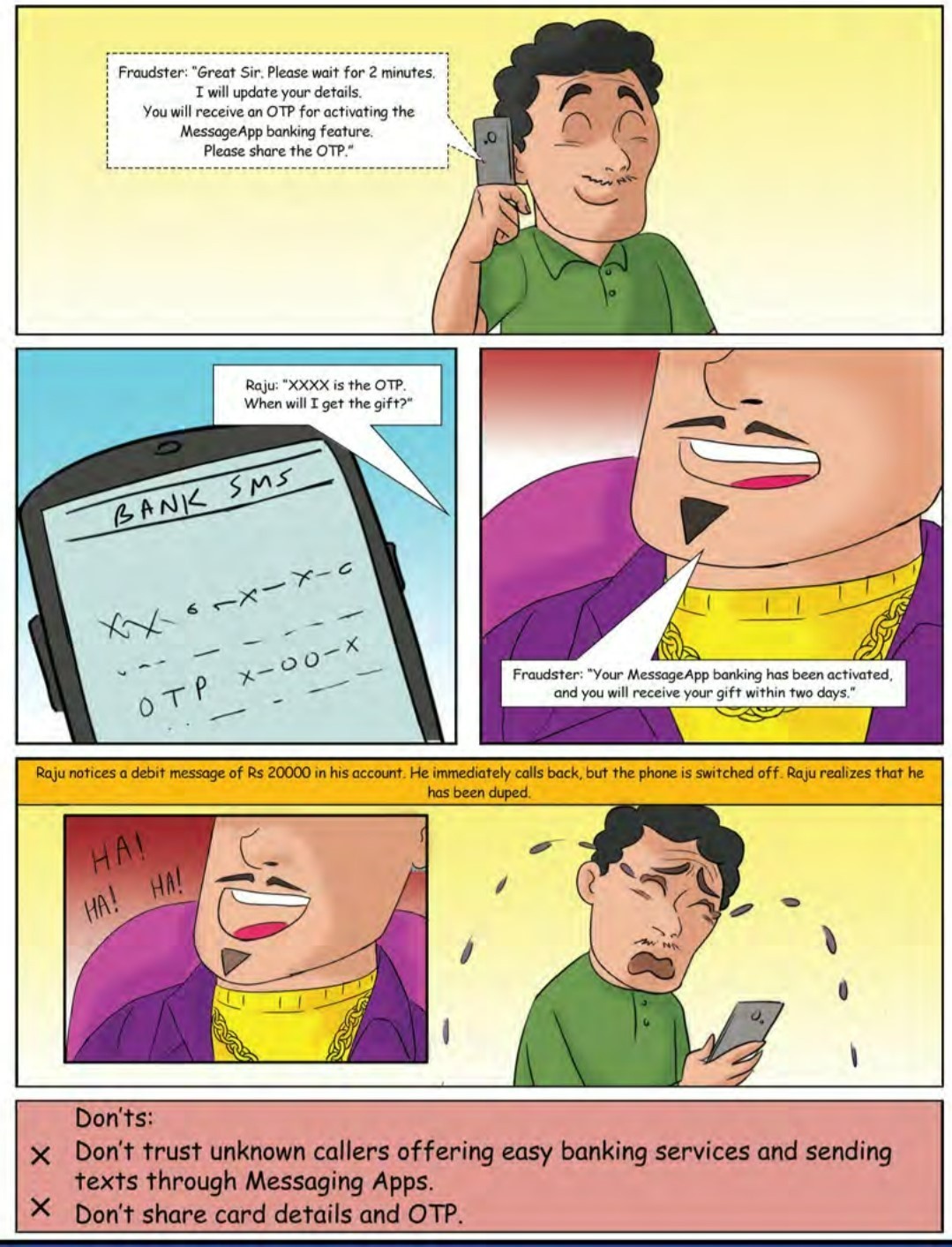

India: The Reserve Bank of India (RBI) recently introduced an interesting approach to educate the public and drive simplified conversations about the various types of ongoing scams in India—in the form of a comic book inspired by the classic ‘Ali Baba and the 40 Thieves’ story. The 80-page spin-off comic book entitled ‘Raju and the 40 Thieves’, uses comic illustrations and the layman’s language to explain about all the modus operandi of financial fraudsters and digital scams as part of its customer awareness initiatives. It offers simple tips and dos and don’ts, with the titular character Raju representing a typical citizen depicting different roles—a senior citizen, a happy-go-lucky person, a farmer, etc.

China: Financial literacy has become such an important aspect of China’s population, so much that it has made its way into the academics sector. In China, anti-fraud courses are taught in colleges and universities as part of the syllabus because the government addresses that many young adults, especially college students, have become victims of online scams and fraud. Jointly carried out by the Ministry of Public Security and Ministry of Education, the campaign will ask students across the country to create short films, videos, animations and posters focused on the theme of anti-fraud, the initiative aims to shed light on the common scams in China, including blackmailing, impersonating a government official to extort money, online dating scams, and more.

These are just some examples of how different countries have been combating online scams and fraud in their own unique ways. In the end, what is important is to understand that fighting scams and fraud is an uphill battle and that it would require all hands on deck to really combat the prevalence of Internet scammers and fraudsters.

No matter which medium or approach we use to spread the word about financial literacy, it is important for the public to first be familiar with all the potential red flags and triggers of possible scam situations. As we continue to progress and benefit from the rapid boom of digitalisation and the online environment, we must also remember to be proactive in building resilience against the risks and threats posed by scammers and fraudsters on the Internet and beyond.