Date

27/September/2024

Share

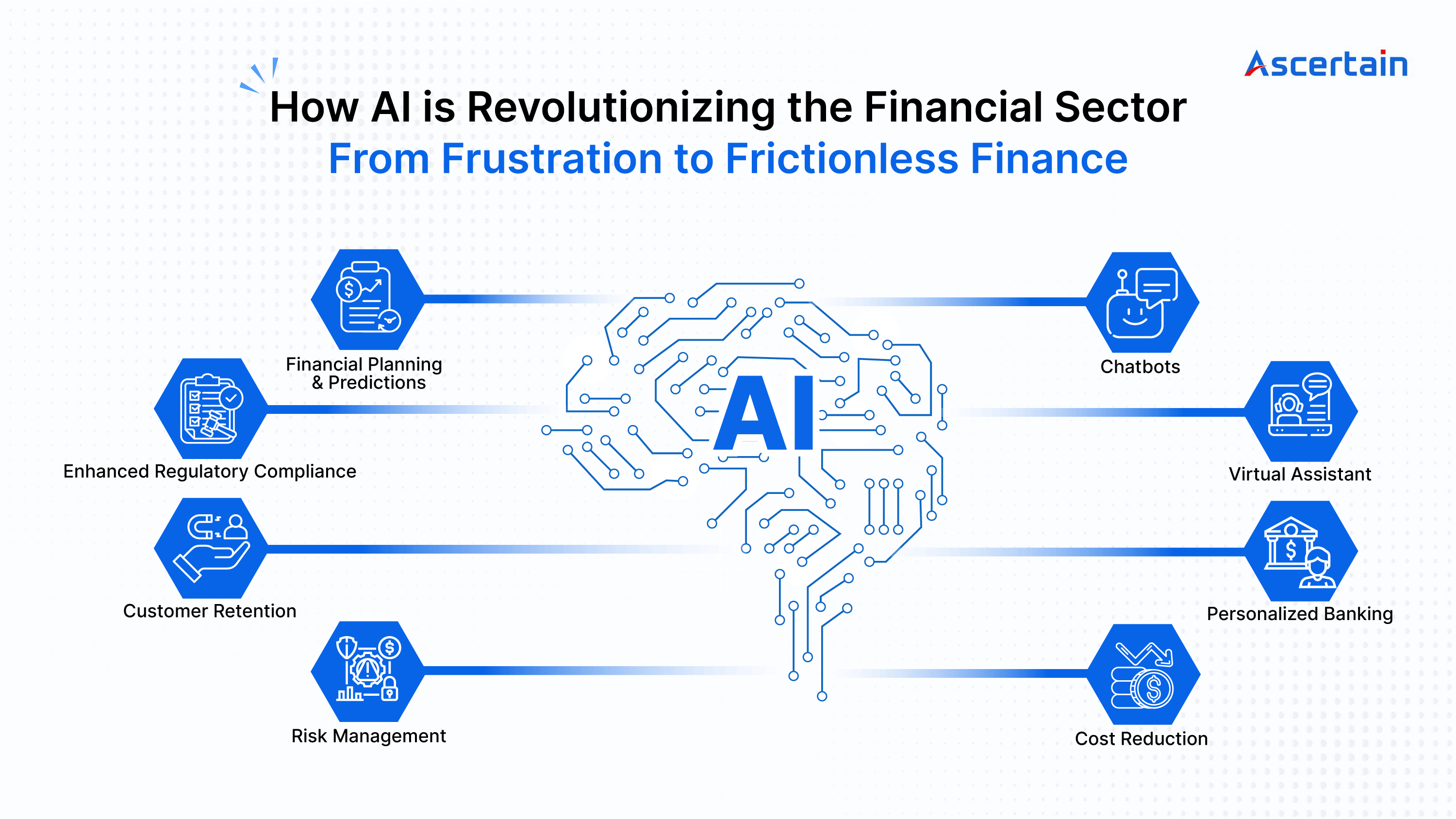

How AI is Revolutionizing the Financial Sector: From Frustration to Frictionless Finance

AI refers to the development of intelligent machines that can mimic human cognitive functions. In the realm of FinTech, AI algorithms are trained on massive datasets of financial information. This empowers them to analyze trends, make predictions, and automate tasks with unprecedented accuracy and efficiency.

Here’s a glimpse into the transformative impact of AI in Banking, backed by real-world statistics:

- Enhanced Customer Experience (CX): AI chatbots are revolutionizing customer service. These virtual assistants provide 24/7 customer support, answer questions in real-time, and can even offer personalized financial advice based on your unique situation.

- Improved Fraud Detection: Financial fraud is a major concern, but AI is proving to be a powerful weapon. According to Accenture, AI-powered fraud detection systems can reduce false positives by up to 80%, saving financial institutions billions and giving you peace of mind.

- Streamlined Operations: Repetitive tasks like loan approvals and credit scoring are being automated by AI, freeing up human resources to focus on more complex issues. A report by McKinsey estimates that AI can automate up to 80% of a bank’s transactional workload, leading to significant cost savings and improved operational efficiency.

- Data-Driven Decisions: AI’s ability to analyze vast amounts of financial data is a game-changer. This empowers investors and financial institutions to make data-driven decisions with greater accuracy and foresight.

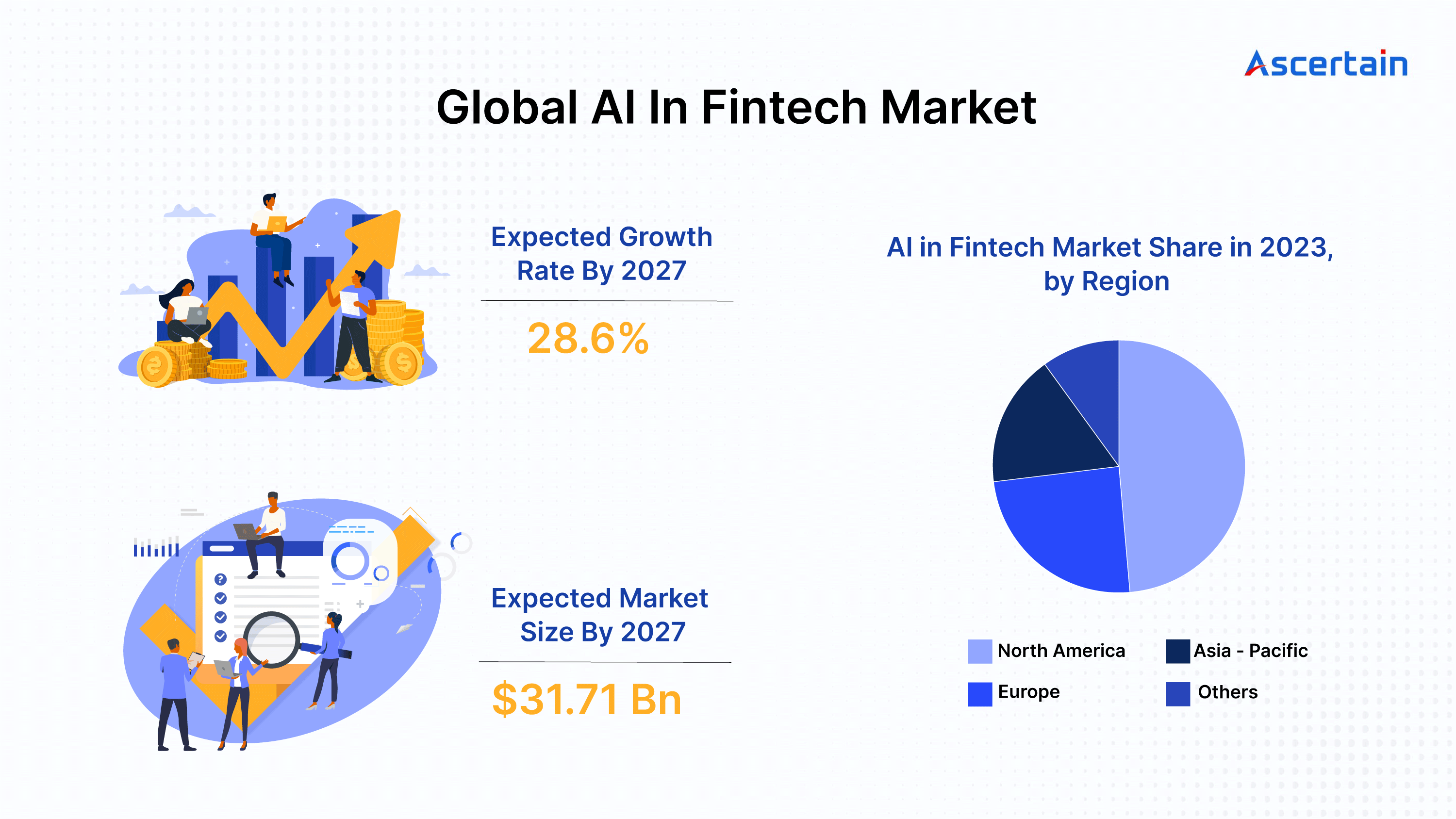

The future of AI in FinTech is brimming with exciting possibilities. Here’s a look at what’s on the horizon:

- Natural Language Processing (NLP): AI chatbots will become even more human-like, engaging in natural conversations and understanding the nuances of human language.

- Deep Learning: Machine learning algorithms will become more powerful, leading to even more accurate financial predictions and risk assessments.

- Collaboration with Blockchain: The integration of AI and blockchain in finance technology has the potential to revolutionize financial transactions, ensuring unmatched security and transparency.

As AI continues to evolve, FinTech will undoubtedly become even more intelligent, efficient, and user-friendly. This future promises a frictionless financial experience, where managing your money becomes effortless and empowers you to achieve your financial goals.