Empowering industries with business process automation, payment domain, robust growth & digital transformation in banking . With our proven business banking solutions and robust FinTech solution platform, we are enabling businesses in varied sectors to harness the power of Fintech, enhance business banking, finance & customer experiences.

FinTech solutions that addresses recurring payment collection challenge in Automotive industry.

Enable direct debit payment option to automate recurring payments and improve business process operation.

Know More

Introduction

Innovative financial solutions for your unique business needs

Benefit from increased revenue and improved customer experiences by integrating with our Fintech solutions.

Apart from engineering innovations, Automotive industries are facing finance’s challenges with the growth in financial technology and evolving consumer preferences. With innovative and modern FinTech solutions and applications, Ascertain is enabling Automotive industry increase business process efficiency and offer enhanced customer experiences.

Our Solutions

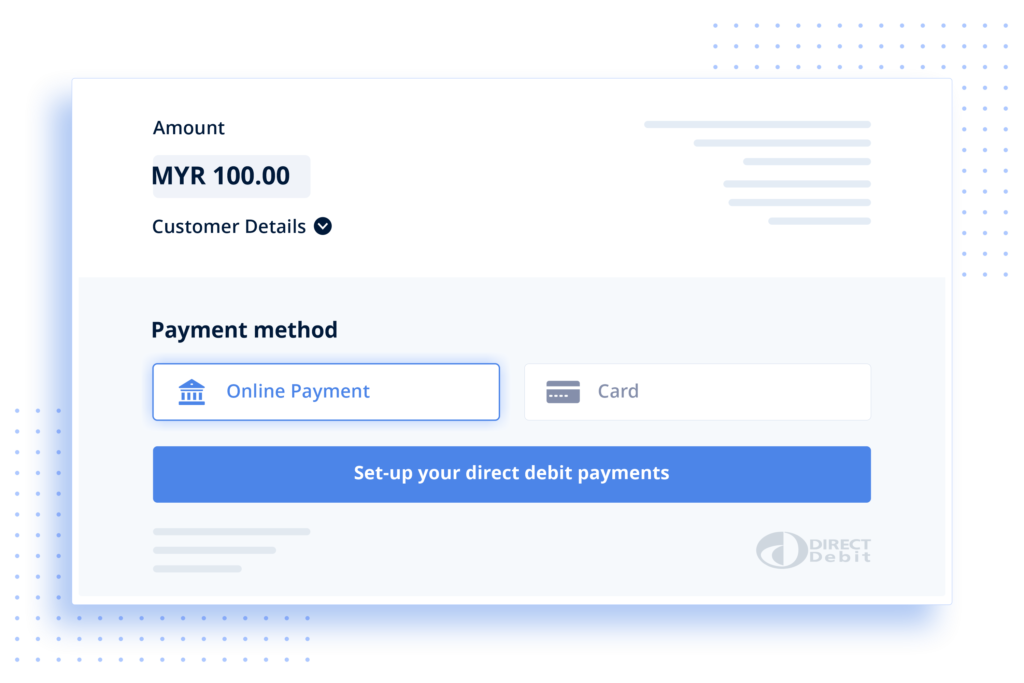

Online direct debit payment for monthly installments

Make your customers dream of buying their favorite automobile true by offering them easy and tailor-made recurring monthly payment installment options and more.

Online registration

Replace paper based direct debit authorization form to electronic via our system and increase process efficiency, hence revenue.

Automate recurring bill collections

Collect recurring payments seamlessly on–time through Online banking/FPX. No more delayed payments and manual tracking.

Pro-tip: Dues will be automatically debited from your customers account upon authorization on the scheduled date and instantly settled in your registered merchant account.

Payment reminder alert

Set alert notification time and date to notify your customers on or before auto-debit due date. Notify via SMS/E-mail to keep your customers informed and maintain transparency.

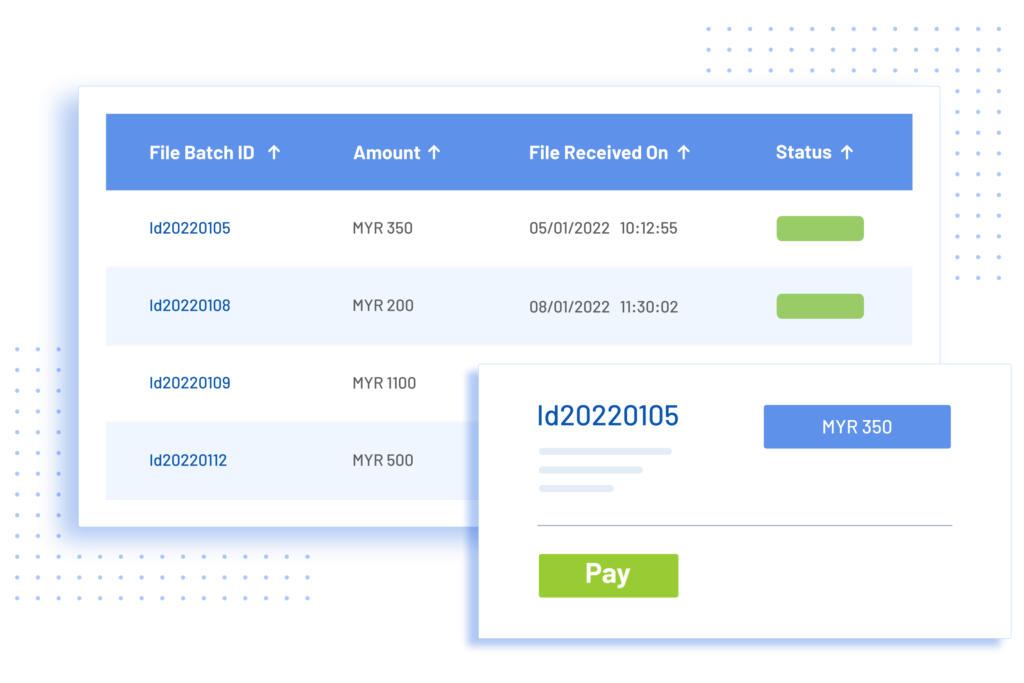

Data analytics and statistics

Track aging reports, conduct automatic reconciliation and maintain account history seamlessly.

Data reconciliation

Save time by automating reconciliation and track payment status easily to offer enhanced customer experiences.

Collection reports

Seamlessly track customer payment activity and overdue payments to make informed business decisions.

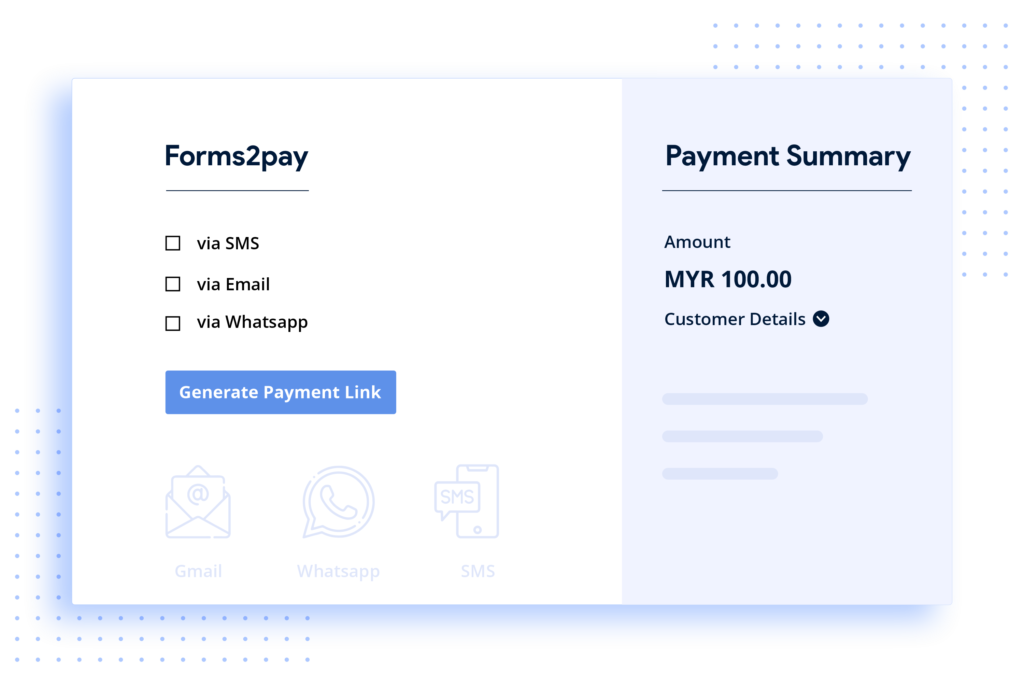

Payment Forms

Create pre-registered custom forms to collect booking fees and customer details.

Forms2Pay

Simply feed in details as per requirement and send request via SMS/E-mail to collect booking fee or registration fee online. Simplify collections and enhance customer experiences.

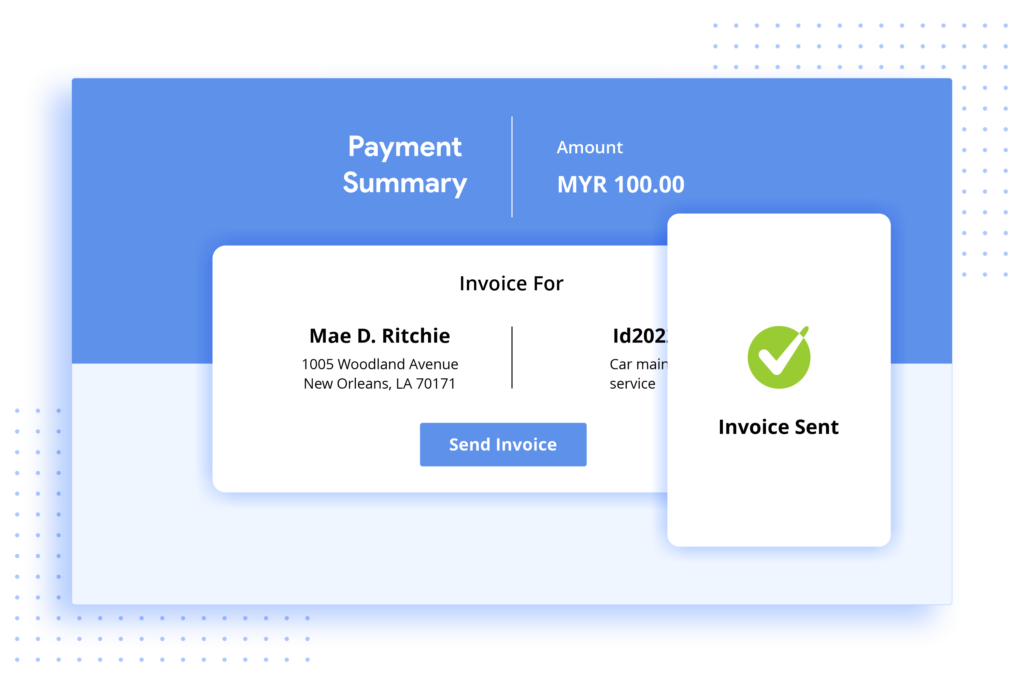

e-Invoice

Send e-invoice to your customers via e-mail/SMS and get paid instantly in one click

Custom invoice

Send customized e-Invoice with your company logo, requesting payments to your customers and getting paid directly to your registered account in one click. Offer your customers multiple payment options including FPX online payment and card payments.

Get more FinTech solutions to enhance payment collection

and increase revenue.

At Ascertain we understand that every business has unique needs and challenged by different problems. Which is where our custom-solution bridges the gap to provide you solutions that are custom-built and unique to suit your business requirements.

Product Features

Adaptive Interface

Our Fintech system easily adapts with your existing system and enhances it by increasing efficiency and productivity.

Scalable

Solutions by Ascertain offers you scalability, enabling you to power up your systems with the latest technology and applications.

Easy to integrate

Our solutions are easy to use and can be easily integrated with your legacy systems offering you scalability.

Empowering industries with business process automation, payment domain, robust growth & digital transformation in banking . With our proven business banking solutions and robust FinTech solution platform, we are enabling businesses in varied sectors to harness the power of Fintech, enhance business banking, finance & customer experiences.

Copyright © 2008 - 2024. Ascertain Technologies Sdn Bhd. All rights reserved.