Guarding Financial Integrity: Ascertain’s Data Quality Management Framework (DQMF)

In an era where data reigns supreme, ensuring its accuracy and integrity is paramount, especially for financial institutions grappling with regulatory scrutiny. Ascertain’s Data Quality Management Framework (DQMF) emerges as the knight in shining armor, offering a robust defense against data discrepancies and consequential revenue loss.

The Costly Consequence of Data Discrepancies: A Global Perspective

The Costly Consequence of Data Discrepancies: A Global Perspective

Foreign banks, navigating the intricate landscape of global finance, have encountered severe penalties due to data discrepancies. In 2021, the financial world was shaken when an internal report from a prominent bank revealed a suspected money laundering network involving a staggering $4.2 billion in payments. The revelation raised concerns about the bank’s compliance practices and disclosure of critical information to regulatory bodies, leading to an $88 million fine by the Financial Conduct Authority (FCA) for “unacceptable failings” in its anti-money laundering systems. For more details on the statistics, click here.

These discrepancies often stem from challenges in maintaining system lineage, where the origin and transformation of data across various systems become convoluted. Such complexities create fertile ground for exceptions, instances where data deviates from predefined norms, inviting regulatory sanctions and monetary fines.

The Regulatory Landscape: Keeping Financial Giants in Check

The Regulatory Landscape: Keeping Financial Giants in Check

Regulators play a pivotal role in maintaining the integrity of the financial industry. Government entities act as spectators, establishing rules, and guidelines, and conducting investigations to ensure compliance. However, as demonstrated by cases, regulatory oversight alone may not suffice, leaving room for financial misconduct to persist.

Beyond Oversight: The Crucial Role of Technology

Beyond Oversight: The Crucial Role of Technology

Ascertain’s Data Quality Management Framework (DQMF) emerges as a beacon of hope in fortifying a bank’s transaction monitoring systems and recognizes the significance of financial data quality. While regulators set the standards, technology serves as a crucial ally in the fight against money laundering. DQMF, through its advanced capabilities, automatically flags suspicious activities, conducts predictive analyses based on transaction data, and offers real-time compliance checks.

Ascertain’s Data Quality Management Framework (DQMF): Navigating the Landscape of Data Perfection

Ascertain’s Data Quality Management Framework (DQMF): Navigating the Landscape of Data Perfection

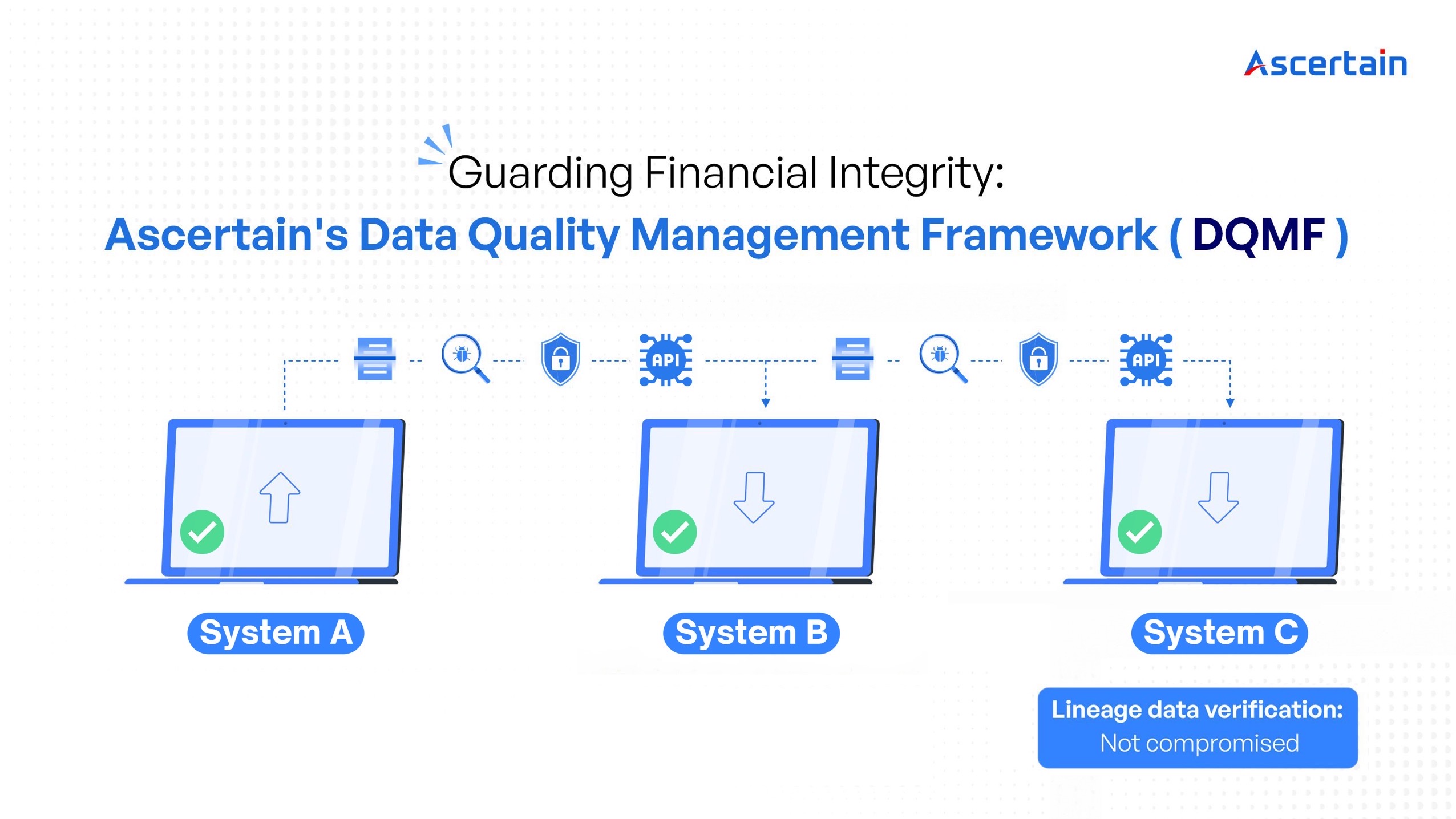

At the heart of Ascertain’s DQMF lies a sophisticated system lineage management mechanism. This ensures a transparent and traceable journey for every piece of data, from its origin to its utilization in critical decision-making processes.

As evidenced by the statistics, fintech companies grappling with fluctuations in funding and dealing with the intricacies of AML and FinCrime need resilient solutions. Data Quality Management Framework, with its advanced capabilities, offers a proactive defense mechanism. Here’s how:

Ascertain’s DQMF: Key Features for Financial Integrity

Ascertain’s DQMF: Key Features for Financial Integrity

- Early Detection of Irregularities: Advanced algorithms enable DQMF to detect irregularities early, facilitating swift action to safeguard funds.

- Predictive Analytics for Risk Mitigation: Leveraging historical and real-time data, DQMF provides predictive insights, empowering financial institutions to anticipate risks and implement preventive measures.

- Enhanced Compliance: Data Quality Management Framework ensures real-time compliance checks, aligning with the stringent regulatory landscape, safeguarding against penalties, and strengthening fintech operations’ integrity.

- System Lineage Transparency: A sophisticated system lineage management mechanism ensures transparent and traceable data journeys, aiding compliance and building trust in financial information accuracy.

- Exception Management: DQMF’s advanced capabilities swiftly identify and resolve deviations from defined data norms, proactively mitigating the risk of penalties associated with non-compliance.

- Automated Discrepancy Resolution: Data Quality Management Framework automates the resolution process, swiftly identifying and rectifying discrepancies, reducing the probability of revenue loss.

Conclusion: Fortifying Financial Integrity with DQMF

Conclusion: Fortifying Financial Integrity with DQMF

Ascertain’s Data Quality Management Framework stands as a beacon of innovation, addressing the critical need for data accuracy in the financial sector. As industry statistics underscore the substantial revenue loss resulting from data discrepancies, DQMF emerges not just as a solution but as a strategic partner for financial organizations worldwide.

Are you prepared to bolster the fortifications around your financial integrity? Take the first step towards unshakeable data accuracy. Unleash the potential of Ascertain Technologies Data Quality Management Framework (DQMF) and confidently navigate the ever-evolving data landscape. Reach out to us now, and together, let’s sculpt a data environment devoid of discrepancies. Your journey to seamless financial integrity starts here. Contact us today for a future of data excellence!