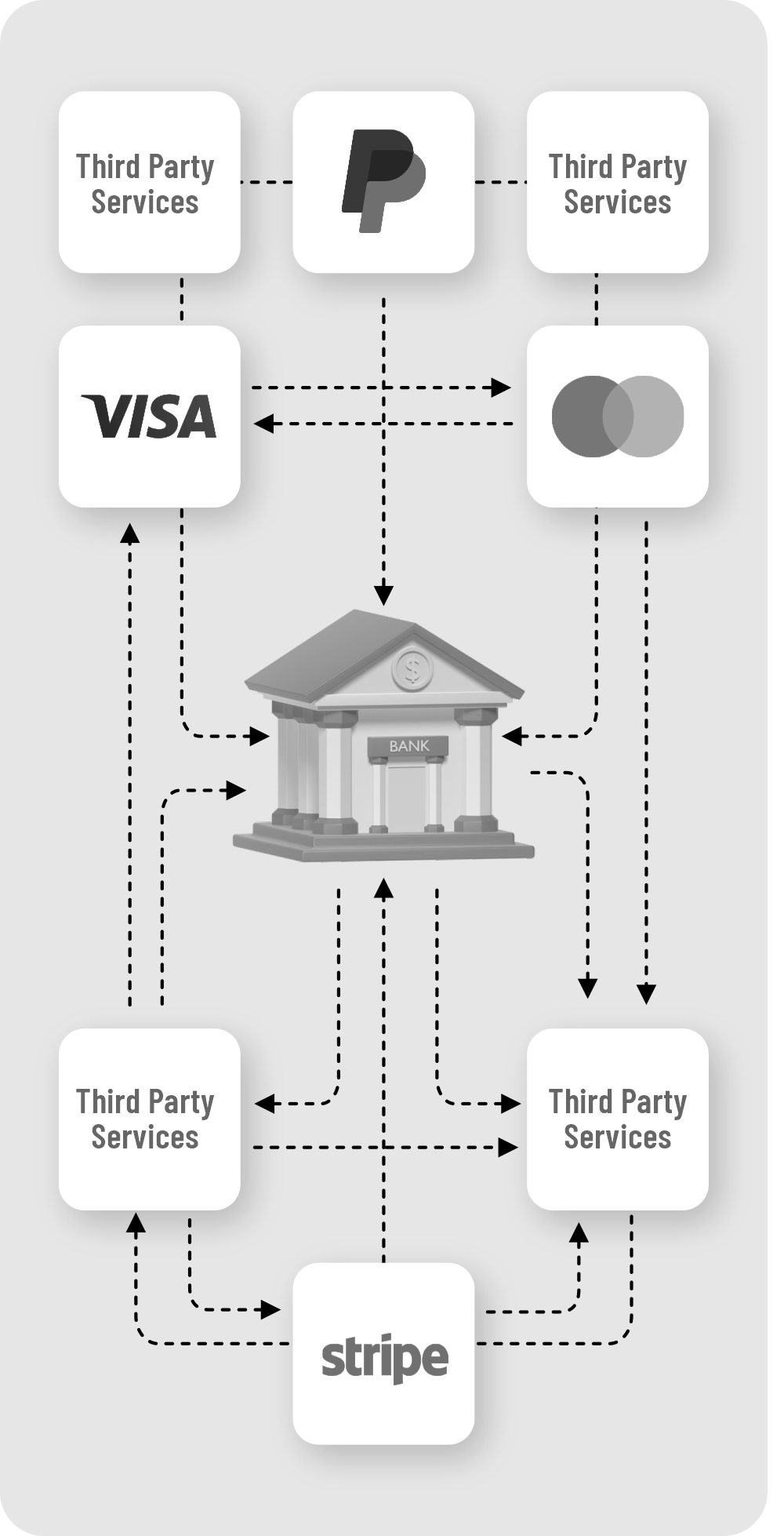

The Challenge

The Hidden Cost of Not Owning Your Own Payments System

Core Capabilities

Built for the Banks of Tomorrow: Three Pillars That Deliver Revenue, Control, and Growth

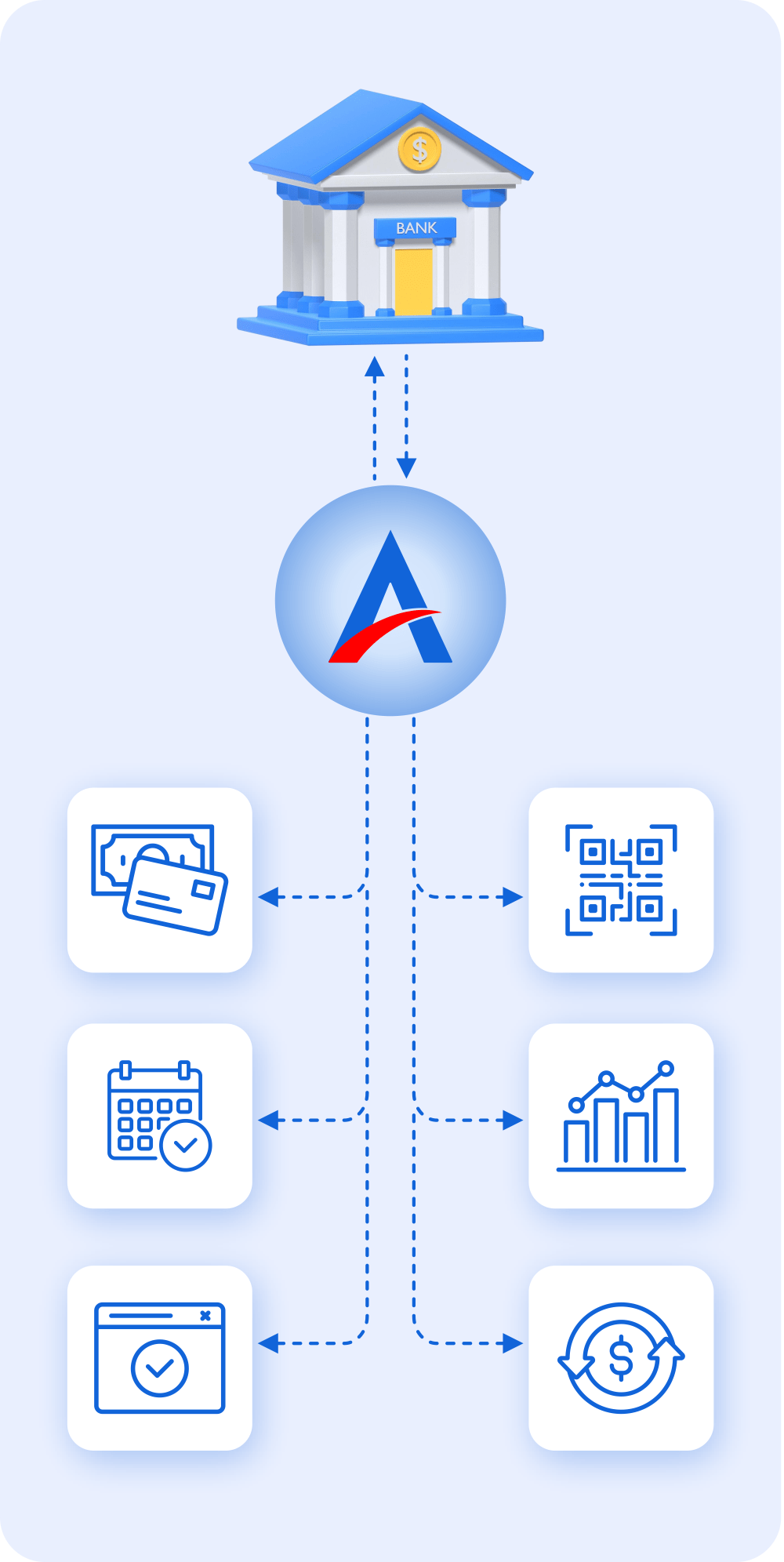

A Complete Merchant Payment Ecosystem, Owned by the Bank

Outcome: Faster revenue, lower operational risk, full control over margins.

Proven Impact

The ‘Ascertain’ Advantage: Global Significance, Proven Across Banking Partners

With insider expertise in BFSI and payments, we help banks tackle technology, operations, and scalability challenges seamlessly.

Fintech Expertise. Banking DNA.