Date

1/August/2023

Share

Open Banking in Asia – Is it game over for the late adopters?

To say that the banking and finance industries are going through a time of change would be an understatement. The finance sector in today’s era is driven towards self-reinvention to better suit changing perceptions and public demands of what a bank or financial institution should be.

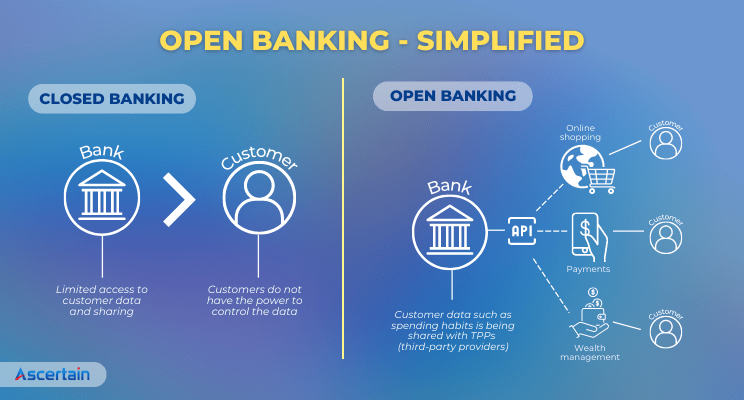

Open Banking: Simplified

To put it in simple terms, “open banking” is the practice of sharing customers’ banking data with third parties electronically under conditions that the customer approves of. Among the data that would be shared with third-party providers are consumer banking and transaction data.

Well, banks have a wealth of information on their customers’ spending, saving, and borrowing habits, from domestic bills and loan payments to shopping and lifestyle preferences; these are valuable data that can be used by third parties like competitor banks and financial technology (fintech) firms to develop new products and services.

From Consumers to Businesses, Everybody Wins With Open Banking!

There is no denying that there have been a variety of successful use cases with regard to the usage of open banking to its full potential. Not only does open banking open doors for consumers to enjoy a more tailored and seamless customer experience, but the sharing of open financial data through API also impacts businesses to a greater extent.

Take the lending industry, for instance – for a long time, this industry has relied upon traditional practices where the public undergoes long, paper-full, and time-consuming loan application processes which generally involve a lot of steps and procedures. However, today, open banking has disrupted this environment by allowing for a more seamless customer experience to take place. Customers no longer need to bend over backward to justify their profiles with potential lenders. Through open banking functionalities, lenders can readily access necessary customer information such as credit profiles and bank statements directly to make way for faster approvals.

Likewise, from a business standpoint, the integration and influence of open banking bring the utmost convenience and productivity to the lending industry. What used to take months is today achievable within a few minutes; where lenders are able to make informed decisions on the sanctioning of loans by assessing their client’s risk tolerance, investment knowledge, and financial position with ease. This ultimately helps lenders to improve their decision-making, handle a higher volume of applications and reduce the rate of non-performing loans (NPLs) under their purview.

The Prevalence of Open Banking in Asia and Around the Globe

In a recent article, Mastercard said that the global open banking scene will continue to grow, as it has been widely adopted in places like the UK, the US, North America, and Europe. Notably, two common ingredients that have greatly contributed to the thriving of the open banking era were (i) the extensive growth of global digital economies and (ii) the strong support and endorsement of the respective local regulators to bring in more competitive financial products and services to the community.

According to Deloitte, countries like India, Japan, Singapore, and South Korea have all been ahead in the “open banking” game, introducing initiatives and efforts to actively promote open banking in their respective financial landscapes. Australia has committed itself to a seamless open banking experience by launching the Consumer Data Right Act, which allows consumers to willingly share their data with their chosen third-party providers.

Hong Kong has taken policy and regulatory steps to speed up the process of implementing open banking with a four-phase game plan. Countries like Singapore have also stepped up their efforts to promote open banking by making it easier for banks to use open bank data. Big banks like DBS, OCBC, and many others in Singapore have followed suit and are actively using APIs and other technologies to form partnerships and join the larger ecosystem.

When Will Malaysia ‘Openly’ Embrace Open Banking?

After the recent release of five digital banking licenses, Malaysia is still very much in the early stages of embracing open financial data. While some of the entities that Bank Negara Malaysia has issued the digital banking license to, including the likes of Grab and RHB Group have announced that the setting up and spearheading of Malaysia’s digital bank landscape will intensify in 2023, there hasn’t been much in the way of game-changing moves from Bank Negara Malaysia (BNM) to truly disrupt the local banking sector in Malaysia.

- Lack of Enforced Compliance: A potential area that is seen as a key stumbling block is the lack of an established regulatory framework to govern open banking in Malaysia. Experts have been quick to point out that without enforced compliance, the standardisation and adoption of APIs across the country could prove to be difficult.

- The Trouble With Trust: With conversations around online scams, data leakage, and private data breach becoming more and more concerning by the day, there is currently a sentiment that open banking would only add further vulnerability as customers’ data could be easily stolen. It is also evident that most Malaysians are somewhat uncomfortable with the sharing of their data with third parties.

- No Cohesion Between Banks and Fintechs: The lines between conventional banks and fintech players have only started blurring very recently in Malaysia. Still, the wider sentiment and fact is that conventional banks and non-conventional financial institutions (fintech) have not been able to embrace co-existence efficiently. The lack of cohesion between banks and fintech has caused them to work more in silos and be unable to co-create consumer-driven services and solutions.

How Can More Countries in Asia, Including Malaysia, Transition Towards Open Banking Sooner?

- Convince the consumers first: Banks and financial institutions should consider looking at open banking from a consumer standpoint rather than just a regulatory one. Fixing the lack of knowledge and consumer stigma about open banking is an important first step to achieving successful adoption and usage.

- Rectify, reassure, and build a game plan: TransUnion’s consumer survey showed that seven out of 10 consumers cited security as the reason they wouldn’t want to give credit providers access to their bank account information. Businesses also placed this as a top priority in the research conducted by Forrester, with 62% of those not planning on adopting Open Banking stating that security concerns are holding them back. These observations make it clear that addressing concerns about data safety is going to be at the heart of increasing adoption.

- Drive conversations from the top: Consumers are always looking for a value exchange; if they get certain benefits, they are willing to share data with banks, mortgage brokers, credit card providers, and credit reference agencies but are less trusting of newer finance providers, such as fintech. This is why it is critical to start conversations at the top, with credible stakeholders such as Bank Negara Malaysia issuing statements of intent to advance Malaysia in open banking.